Will the gold standard return?

Jan Vlieghe, a member of the Bank of England's (BoE) interest-rate setting committee recently made a comparison with the UK's monetary policy and The Weimar Republic. According to his convoluted logic, we don't have to worry about hyperinflation because the BoE is controlling monetary policy and not the government which was the case in Weimar Germany.

Referencing The Weimar Republic and Zimbabwe (where money became so worthless it was used as fuel) probably isn't the best idea when trying to gain public confidence. Regardless of what is spoken, you only need commonsense to realise something isn't right. It's not just the UK, the money printing press is out of control, the world over.

Governments ♥️ fiat currency

First things first, governments don't want a gold standard. A return would only come about because public confidence is lost with fiat currency. Currency backed by gold forces sound economics which governments don't like, they prefer an "elastic money supply" which is a euphemism for currency debasement.

Funding war is a good example of this, a non-elastic gold standard makes this more challenging. Most European countries abandoned the gold standard during World War 1 so they could print more money to finance war efforts. It's why America under Richard Nixon came off the gold standard in 1971 because the Vietnam war was becoming so expensive. In summary, governments prefer the lack of restraints fiat currency offers.

"We have gold because we cannot trust governments."

President Herbert Hoover

Parallels with the Roman empire

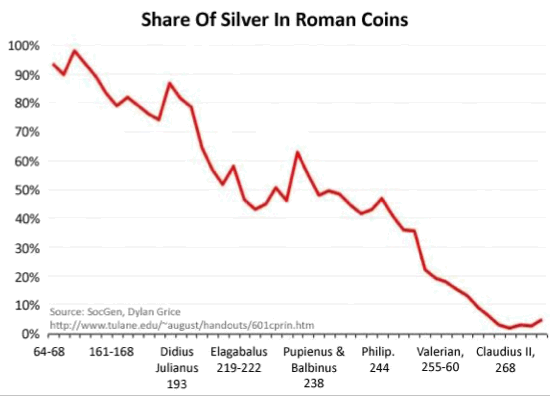

The debasement of currency is nothing new. The Roman's debased the denarius coin over a 200 hundred year period by using less silver. Rome could produce more coins by reducing the silver content and stretch its budget. The unfortunate side-effect of all of this was hyperinflation. Coin debasement and inflation were considered the leading factors in the Roman Empire's eventual collapse.

Debt monetisation = coin debasement

In the absence of silver coins, governments have a new accounting trick called debt monetisation. Central banks purchase government debt in the private market to keep interest rates low, and in a sense, monetise government debt. Through this purchasing, central banks support the inflation of the government’s debt to levels where it is not clear how it will ever be repaid.

We're in a highly unusual situation where governments no longer need to service their debt. This comes in the form of negative interest rates and guaranteed debt rollovers. How is any of this different to debasing silver coins?

Store of value

Money backed by gold creates a low inflationary environment which means it's a store of wealth (prices don't change much). The gold standard removes the power from governments to increase the money supply. This is compared to prices doubling every 20 years (based on average annual inflation), which is the same as your money halving in value. This is good for governments because it erodes their debt, needless to say, it's terrible for savers.

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation."

Alan Greenspan

Less war

Funding war becomes a lot harder when there's no printing press. During World War 2 when America was still on the gold standard they largely funded their efforts by raising taxes and selling war bonds to the American public.

There's no disputing this was a worthwhile endeavour but can you imagine a similar situation with the Iraq war? Imagine Tony Blair telling the British public that taxes are increasing to fund an invasion. There would have been riots on the streets. When politicians can no longer invent money out of thin air, then inevitably there will be far fewer or at least shorter pointless wars.

Why would a gold standard return?

A gold standard would return if the population lost confidence in fiat money. This would happen a lot quicker if more people understood how the system worked. That is, if we can’t pay back the debt, let’s print more. It's no different to a Ponzi scheme. It's possible that confidence has started to erode in the dollar, data released by the World Gold Council shows record amounts of gold being purchased by central banks in recent years.

“Money is gold, nothing else.”

JP Morgan

Summary

History tells us that fiat currency has a terrible track record, from the Roman denarius to the Argentine peso. The British pound is the oldest surviving fiat currency and has lost 99.5% of it's purchasing power while the younger dollar 92%. Even the most prudent would surely agree that over a long enough timeframe; the dollar, pound, yen and euro will eventually be replaced.

When you boil gold down it's simply a currency which has been considered valuable for 5,000 years. The boom in cryptocurrencies is just a way of saying "we want change" and "we don't trust the current system". While I don't believe Bitcoin is the answer, a cryptocurrency backed by the tangibility and solid track record of gold could well be.

Further reading

Currency and the Collapse of the Roman Empire:

https://www.visualcapitalist.com/currency-and-the-collapse-of-the-roman-empire/

Central banks make record gold purchases:

https://www.ft.com/content/b62ebb1a-b3a6-11e9-bec9-fdcab53d6959

Did The Gold Standard cause The Great Depression?

https://www.forbes.com/sites/nathanlewis/2020/02/25/did-the-gold-standard-cause-the-great-depression/