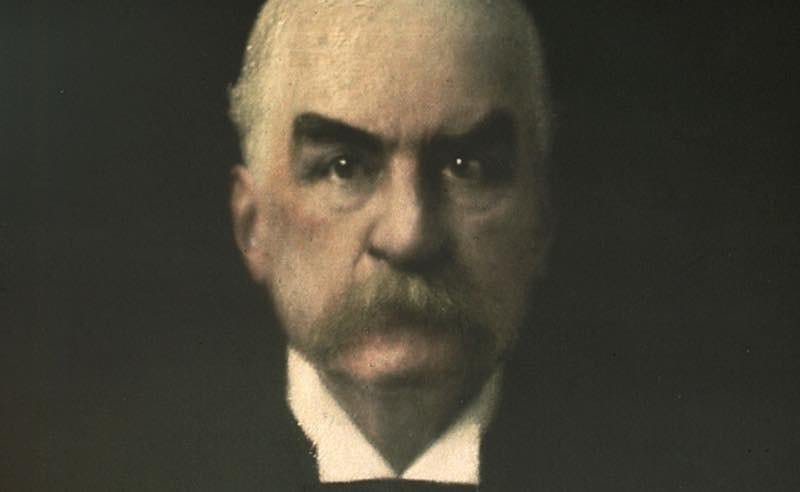

Gold is money everything else is credit

It was J.P. Morgan who said "Gold is money everything else is credit". He said that back in 1912 when the dollar and most developed currencies were backed by gold. Bearers of paper notes had a promise to be able to exchange their notes for gold. Credit, in essence, is a promise to pay. So this is what J.P. Morgan meant by saying "Gold is money everything else is credit". It was a reminder that unless you have gold in your procession then you don't have money (only paper).

Fast-forward in time and there's no gold standard, you can't exchange your dollar, pound or euro for anything of value. Money has become an elusive concept.

Money vs currency

When we were on the gold standard, the difference between money (gold) and currency (paper) was straightforward, but today it's confusing. If you asked 10 people, I doubt you'd get a straight answer. Currency is defined as the medium and on the gold standard, it was very clear: paper dollars and pounds represented the money, money being gold. So what is money now that our currencies are no longer exchangeable for precious metals?

Money is debt

It's easy to understand how money used to be created: tons of effort and resource (energy) through mining. Today, no energy is required to create money. Money is debt. It's made from thin air and costs nothing. Money is created when you take out a loan from a bank or when central banks purchase government bonds. This is when money is born.

There's a lot of misconception around how banking works, in the UK the fractional reserve system no longer exists or it doesn't work how people think it does. And it was the Bank of England who cleared it up in one of their quarterly bulletins:

"Rather than banks lending out deposits that are placed with them, the act of lending creates deposits — the reverse of the sequence typically described in textbooks ...the relationship between reserves and loans typically operates in the reverse way to that described in some economics textbooks. Banks first decide how much to lend depending on the profitable lending opportunities available to them…It is these lending decisions that determine how many bank deposits are created by the banking system."

The fiat money in your bank account was borrowed into existence. Gold or silver was the only form of money that wasn't someone else's debt.

The other non-intuitive concept to understand is that money is destroyed when debt is paid off. This means the money supply would shrink and the economy would collapse if everyone stopped borrowing and started to save. We need more debt otherwise the system collapses. Money dies when we pay off debt.

"That is what our money system is. If there were no debts in our money system, there wouldn't be any money."

Marriner Eccles - FED Board chairman

Easy money

I sometimes wonder how ethical our easy money system is. It sounds great, creating money from thin air, but it needs to be paid back. The debt being created is simply taking money from the future and bringing it into the present. And it's the people of the future that have to pay it back. It's analogous to buying a home and having to pay back the debts of the families that lived there before you.

Living within one's means

The gold standard constrained the money supply, it meant living within our means. Politicians, however, like spending to ensure re-election, they like an elastic money supply.

Examples of callous spending by governments are many, one that's fresh in my mind is that of the covid track and trace system in the UK. It's essentially an app that most people consider a failure. Depending on where you read, the cost ranges between £12 -37 billion. This translates to between £180 and £540 per-person for everyone living in the UK. Would such a mind-boggling amount have ever been spent if money wasn't so easy to create? I doubt it. It's now the burden of the entire population for many years to come.

In WW2 the US had to increase taxes to pay for the war, the gold standard prevented easy access to money. This was obviously a noble cause, however, how do you think the public would feel if taxes were being raised to pay for the Iraq War? My guess is there would have been significantly more demonstrations around the world, in fact, there may not have even been a war, or at least a lot shorter.

Just as we are waking up to the fact that we can't keep plundering the earth's supply of natural resources. The same consideration needs to be done for the earth's money supply, if it's not constrained then it means unlucky generations get to carry the can and suffer the hangover of the previous generation's party.

Store of value

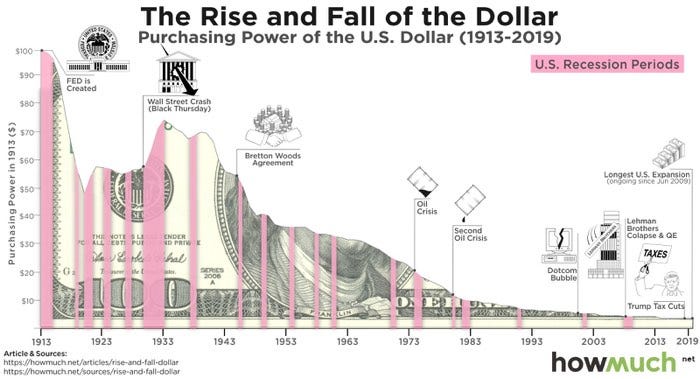

One of money's function is to act as a store of value, however, when money is made so easily, it does a terrible job. A good example of this is the American Gold Double Eagle coin with a face value of $20 and is priced today above $1,800. This price increase isn't to do with the price of the coin or gold going up since 1849, it's that the value of the fiat dollar has gone down.

Giving a stranger your credit card

Governments are wasteful when they spend our money. This isn't unique to governments, caution is only had when it's our own money we spend. Just like we wouldn't give a stranger our credit card, that's in essence what we do with governments and the fiat money system. At least under the gold standard, it meant governments were only trusted with our debt card.