Changing demographics: investing for an older population

In Japan (the ageing capital of the world), adult nappies outsell baby nappies and prisons are being converted into nursing homes. The developed world is ageing rapidly and having far fewer children. By 2050 the number of over 65s is projected to double. In parallel birth rates are plummeting which means the consuming cohorts are in decline. This colossus demographic change will cause fundamental changes to the economy and change how governments and households spend, all of which could influence how to invest.

Declining birth rates

The maths are simple: unless women have on average 2.1 children or more then the population eventually declines. And this has started to happen in Japan where the population decreased by more than 500,000 in 2019. The table below highlights some of the countries with the lowest fertility rates. This transition will likely be painful with fewer taxpayers supporting a large older population, the only solutions are immigration, technological innovation or exporting economic growth.

Urbanisation the cause

Most demographers believe that urbanisation is a leading cause of declining birth rates. Living in a small and expensive home is going to affect how many children we have. The Industrial Revolution moved us from farms to cities -- on the farm, we needed more children as it meant free labour but in the city, children became luxuries (an expense).

“On a farm, a child is an investment—an extra pair of hands to milk the cow, or shoulders to work the fields. But in a city a child is a liability, just another mouth to feed.”

Empty Planet: The Shock of Global Population Decline

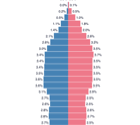

Population pyramids

A population pyramid is a chart that shows the distribution of age groups in a population and forms the shape of a pyramid when growing. The bottom age groups (bars) are 0-4, followed by 5-9, 10-14 etc. The population pyramid on the left is Spain in 1960 and 2020 on the right. This shows the drastic changing demographics due to lower birth rates and increased longevity. This shift in demographics creates a massive strain on the economy as you have a dwindling proportion of the population paying tax and consuming to support a growing older population.

Japan

About 25% of Japan's population is above 65 and it's projected to increase to 40% by 2060. Japan has one of the highest rates of longevity and lowest rates of fertility with a declining population that began in 2011. Sexual abstinence is just one of the reasons behind their changing demographics.

Europe

Almost all of Europe is ageing, especially Germany, Italy, Portugal and Spain. Other than France, fertility rates across Europe have declined well below the 2.1 children needed to maintain population size. The obvious solution is also what's most devisive: immigration.

USA

While the USA's population pyramid isn't ideal from an economic perspective; compared to the rest of the developed world (especially Europe) it's okay. Moreover, they have a large working Millennial cohort to help see them through for a few years.

Investing ideas for an older population

Needless to say, as we get older our spending habits change. This is most prevalent when we retire and stop going to work -- we spend less on transport, eating out and the latest gadgets. Consumption-led growth is no longer a given in many markets as the working population declines and the older population increases. But with an older population booming, let's look at some ideas that could benefit from changing demographics.

Ageing population ETF

There's an ETF for just about everything, so no surprise they exist for the theme of an older population. The iShares Ageing Population ETF invests in holdings that provide products or services to the world’s ageing population and is spread across sectors and markets.

Healthcare

An obvious play on an ageing population is buying into healthcare. Listed below are just a few ETFs with various market splits and themes. I like the idea of being overexposed to Europe with its older demographic and higher healthcare needs.

Healthcare REITs

Healthcare real estate investment trusts invest in property for the elderly and are another good play on changing demographics. There are several in the UK, two with yields around 6% (at time of writting) are Target Healthcare and Impact Healthcare.

Travel

Retirees have more time to travel and cruise liners are a popular option with the older population. The biggest cruise line stocks are Carnival, Royal Caribbean and Norwegian Cruise Line, however, these are different companies post-Covid with eye-watering debt and could be risky.

Dividend paying stocks

The rules used to be: shift money from equities into bonds as you got older. The problem is that bonds no longer work -- no one wants a 10-year bond that yields less than one percent which is a negative real return. And things are unlikely to change as governments have record debt and can't afford for interest rates to increase. This will force retirees into riskier stocks that offer income. There are many income-focused funds in the UK, here are a few:

Robotics and automation

Countries with shrinking working populations are likely to use productivity-enhancing technologies such as robotics or artificial intelligence. There are funds such as iShare Automation & Robotics but it's worth looking at the fund breakdowns -- I'm personally not excited about owning Social Media or big tech companies that make 99% of their income from selling phones or advertising.

Summary

I feel uneasy investing blindly into a stock market index fund because history tells me there will always be growth. Anyone that believes this should look at a 35-year chart of the Japanese Nikkei. With the working and consuming population in decline, it may require looking outside of traditional ideas for growth.

Related reading and watching

Population pyramids:

https://www.populationpyramid.net

World Population Ageing:

https://www.un.org/en/development/desa/population/publications/pdf/ageing/WorldPopulationAgeing2019-Highlights.pdf