Becoming frugal is fashionable for a generation post COVID-19

Experiences shape a generation. Just as the Great Depression and war shaped the Silent Generation, Millennials will be shaped by the Great Recession, student debt and another serve recession/depression. Millennials and the Silent Generation have shared similar economic challenges so it's fair to say they will have similar character traits. Becoming frugal will be a necessity for many Millennials and Gen Z.

The Silent Generation

The Silent Generation (born ~1928-45) grew up during lean times, including the Great Depression and World War 2. Based on their childhood experiences and the insistence from their parents to be frugal, they tend to be thrifty, unwasteful and maximise property lifespan.

Millennials

Millennials (born ~1981-96) like the Silent Generation, have inherited daunting financial circumstances. Most of their working career has been through a slow-growth period with lingering student debt. Millennials tend to be wary and with an uncertain economic climate for the foreseeable future, frugality will become a necessity.

Events that shaped generations

Trying to understand events that shape generational cohorts isn't an exact science. Depending on when events happen and whether you were born at the beginning or end of a cohort mean there's overlap. Moreover, everyone that experiences a big event is influenced to some degree regardless of your birth date. This is why generational marketing is often criticised for being too broad-brush. With that being said, here are the big events that are thought to have influenced the living generations of today:

The Silent Generation (1928-45)

The Great Depression, the Korean War, the Cold War and the Space Race.

Baby Boomers (1946-64)

The aftermath of World War 2, Television, Rock and Roll, the Swinging Sixties and the Vietnam War

Generation X (1965-80)

The Internet, the dot.com bubble, the AIDS crisis, the Gulf War

Millennials (1981-1996)

9/11, The Great Recession, gay marriage, social media and climate change

Gen Z (1997-2012)

Smartphone ubiquity, identity politics, the rise of populism and COVID-19

Success is mostly luck

Your future prosperity is significantly influenced by when you were born. If you're starting your career in a downturn then it stands to reason your career options will be restricted, moreover, analysis shows that it can be much further reaching. In the book Outliers, Malcolm Gladwell demonstrates that not only the year but the month you're born in plays a major role in future success.

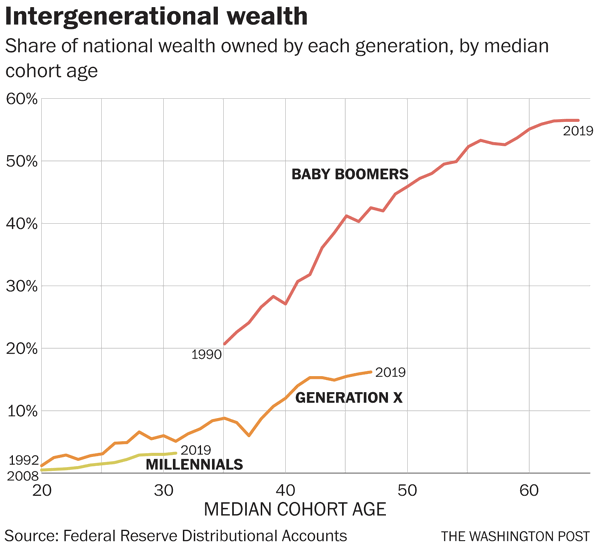

Baby Boomers had it easy

The boomers inherited a strong post-war economy and faced no major recessions. Some argue that this generation has enjoyed a larger share of the nation's wealth while failing to invest for future generations. The below chart is based on data from the Federal Reserve but will also be representative of other counties.

Becoming frugal during lockdown

Becoming frugal has become fashionable for everyone during the coronavirus lockdown. This includes making bread, pasta, cakes, yoghurt, cutting your own hair and exercising outdoors instead of the gym. It's been a real back-to-basics experiment that I'd argue many people have enjoyed. This event has made people reevaluate how they spend their money and time. In a post coronavirus world or once we've learnt to live with it, things are unlikely to go back to how they were. We were in a slow-growth environment before COVID-19 and it's now exacerbated.

Frugal winners and losers

Here are some of the activities and consumption habits that are quite likely to change for future frugal generations.

Exercise

I can't be the only one that's been questioning my gym membership fee while they've been shut. My lockdown routine has involved a run outside and various strength exercises with a single kettlebell. The only thing I miss from my gym is the swimming pool but there are plenty of PAYG pools (once they re-open). There's the obvious cost-saving from doing your exercise at home, moreover, gyms will be a hotbed for spreading germs. I don't see gyms recovering their memberships numbers for years to come.

Eating/going out

Judging by internet dating profiles, being a foodie was considered an activity, indulging oneself with fine dining and wining. With leaner times ahead this will be less of a thing for many, we've all experienced the satisfaction of baking cakes, bread, pasta while in lockdown and these new founded skills will be more of a norm with people cooking for each other more.

Holidays

There's no fear of holiday going out of fashion, however, the amount spent and where people go could change. The Czech's are renown for being frugal when it comes to holidays. One of their top holiday destinations is camping in Croatia and getting there by car. There will be a record amount of UK people holidaying in the UK this year post lockdown, I would expect a trend of less extravagant holidays to continue.

Haircuts

There's been an explosion of people cutting their own hair. Judging by the Youtube videos I've watched, I was surprised to see how good a job is possible. I don't expect hairdressers to go out of business anytime soon, but cutting your own hair may no longer be done by the fringe population (pun intended).

Coffee

Buying a daily takeaway coffee which amounts to £50 - £80 per month has always felt decedent to me. Moreover, the coffee is rarely that good, especially from the likes of Starbucks. You can save a ton of money and make tastier coffee by doing it yourself.

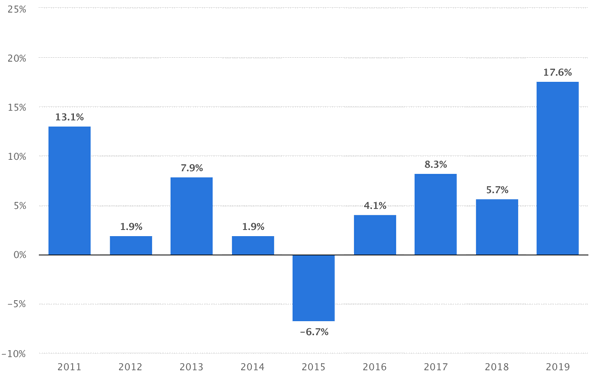

Secondhand economy

The secondhand economy is bigger than it's ever been. A lot of this is driven by Millennial and Gen Z concerns on the environment and because of economics. Last year alone, the UK's second-hand economy grew 17.6%. Moreover, the secondhand clothes market has grown 21 times faster than retail sales in the United States.

Transport

UK trains and tubes have been overcrowded and overpriced for too long with no end in sight. With record numbers of people working from home and purchasing bicycles, this should translate into fewer people needing to use public transport going forward. Anyone that's had the misfortune of using trains, tubes and buses in rush hour will know this is a good thing.

Offices

Twitter CEO Jack Dorsey, recently told his employees that they can work from home "forever". Big boring businesses have been slow to reform on the old school way of thinking "you can only work if you're in the office". But more forward-thinking leaders like Dorsey know that work is an activity, not a location. Expensive office space is an unnecessary expense for many businesses, certainly more start-ups than ever before will delay the cost of offices even further.

Summary

"We spend money we don't have, on things we don't need, to make impressions that don't last, on people we don't care about."

Tim Jackson

A generational shift towards less consumption and becoming frugal has already been happening and the coronavirus pandemic is likely to accelerate this. Lowering consumption is the only answer to combating climate change but this is in direct competition with GDP and shareholder growth. A mass behavioural shift towards less consumption could be the one good thing that comes out of the coronavirus pandemic.

Further reading

Millennials poorer than previous generations, data show

https://www.ft.com/content/81343d9e-187b-11e8-9e9c-25c814761640

Why Aren't Millennials Spending?

https://www.npr.org/2018/11/30/672103209/why-arent-millennials-spending-more-they-re-poorer-than-their-parents-fed-says

Money Habits of the Millennials

https://www.investopedia.com/articles/personal-finance/021914/money-habits-millennials.asp