Achieving Financial Independence with Property

In this post, I'll document my journey into Financial Independence (FI) using the income from one rental property in the U.K. as an alternative to the stock market. A lot of Financial Independence Retire Early (FIRE) blogs and books refer to property as a poor investment.

However, this is often written from a U.S. perspective where there are differences with property taxes, the rental market and property price appreciation compared to the U.K. I'm not suggesting property investment is a better approach but investing in index funds doesn't have to be the only approach. I wouldn't be close to achieving FI if it wasn't for the U.K. property market.

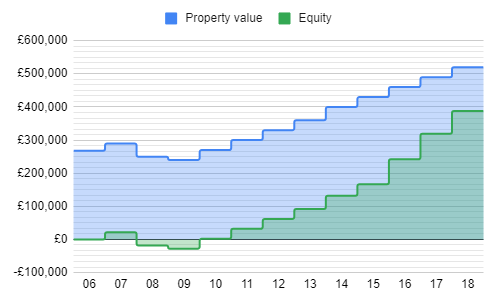

Leverage

Banks won't lend you money for the stock market but this isn't the case for housing which offers a great opportunity for leveraging cheap debt. This is highlighted in the following chart with my property price and equity increases since purchasing in 2006. (Based on a valuation of £520,000 in December 2018.)

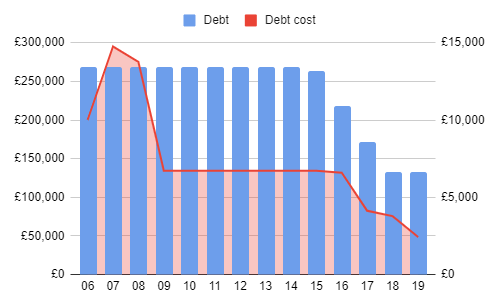

The following chart shows what I've owed on an interest-only mortgage since 2006 with interest payments. (I only started to pay down capital in 2015).

Income

I worked abroad for a long period of time which meant it was rented and earning income. The below chart shows my costs, gross and net income. My net income goal of £19,000 per annum by 2022 is highlighted on the right which can be achieved with no debit and the optimisation of running costs.

A key aspect of gaining financial independence is to reduce the operating costs of my property. Paying off debt is the obvious one, the other costs I'm able to influence are rental fees and repairs. See the chart below which shows my operating costs since 2006.

While living abroad I had to use a property management service to look after my property and find tenants. On average this was ~£2,500 per annum. Since moving back to the U.K. I continued using a property manager (only through laziness) but have recently made the change to self-management.

I now wish I'd made the change a long time ago. Anyone, that's had the misfortune of working with property management companies will know what I'm referring too. My experiences were with Winkworth and PurpleBricks and both were truly terrible.

Repairs are another cost I have some control over. Now I'm managing the property I can find reasonable quotes. Moreover, I'm learning to be more hands-on and undertaking many of the repairs myself. Not only does this save me money but the quality of work improves. It's surprising how poor the workmanship quality is around my flat after many years of mismanagement from Winkworth and PurpleBricks. Good handypeople seem to be in short supply in London.

Safe withdrawal rate

In my opinion: the simplicity of my safe withdrawal rate (SWR) is an advantage compared to cashing in a fixed amount and hoping my lump sum doesn't run out. I simply spend what's been earnt minus running costs and depreciation.

There will be years when I get hit with rental void periods or the boiler breaks down but that means I spend less or do a part-time gig to fill the gap. Yes, a tenant could stop paying the rent but by managing the property myself, not only do I save money but I also get a better feel for who's being let into my flat, moreover, there's insurance that covers this. On average though, I expect to be able to withdraw around £1,400 per month.

Tax

Unlike stocks that can be contained within a tax-free ISA account, a rental property cannot. I'll need to pay £1,298 in income tax based on my projected annual income of £19,000. This leaves £17,702 or £1,475 per month. Other property tax considerations that can be good or bad include:

There's zero capital gains tax (CGT) when selling the home you live in (your primary home). This means you can make a hefty profit, downsize and take the profit with zero tax.

However, if you rent out your primary home and sell your property then you could be liable for CGT. You can claim letting relief on your primary home though.

There is CGT when selling a second home (a home you don't live in). Basic-rate taxpayers pay 18% on gains, while higher rate taxpayers pay 28%. But the gain you make quite often changes your tax band (rate). This probably means you'll be paying 28% on the profit if you make a decent gain on your property.

There's a tax-free capital gains allowance of £12,000 (not just applicable to property). This means the first £12,000 of profit from selling a second home will be excluded from CGT.

You can earn up to £7,500 tax-free per year by renting out a spare room(s) in your property.

It's not passive

Needless to say, earning income from property isn't passive. Tenants will contact you with repairs and you'll to need to find replacements when they leave. Moreover, there are contracts and inventory reports that need doing, however, there are companies that make this easier for you. Using a property management company isn't an option as most of them are terrible and seriously erode your profits. But, if you're not fazed with some occasional DIY and admin then I don't see it as an issue. It's certainly passive enough for me and gives me an excuse to learn skills I didn't have before.